Financial freedom comes with a lot of hard work, determination, and planning.

Some people don’t even know where to begin!

So, I wrote this blog post to help others being their journey on becoming financially free!

Debt

The less you owe, the more free you are.

The biggest leap in financial freedom that I ever experienced was not when I sold my company or during the months that I earned the most, it was the day I became debt free.

The day you become debt free, everything changes.

You start to accumulate money quickly because when you don’t have debt, the money that’s coming in, starts to pile on top of itself.

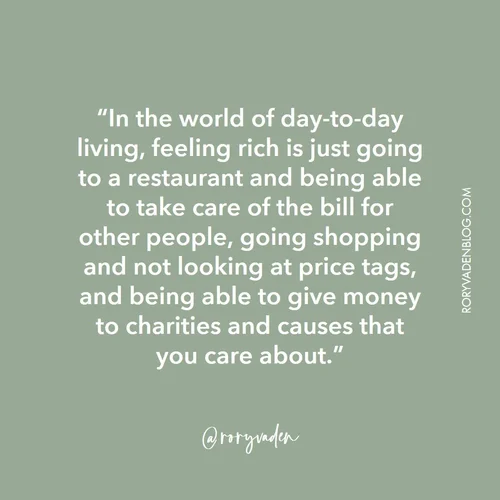

It actually doesn’t take that much money to feel rich.

Being rich isn’t having a private jet or a Rolls Royce, but actually, in the world of day-to-day living, feeling rich is going to a restaurant and not worrying about the prices and being able to take care of the bill for other people.

It’s going shopping and not looking at price tags.

It’s being able to give money to charities and causes that you care about.

It’s not so much about the volume of money that you have, it’s being free from the idea that you owe money.

It’s being free from the idea of being trapped into feeling like you have to constantly keep earning more money because you’re chained down by debt.

Delegation

The second key is that the less you’re required, the more free that you are.

The less that you’re required in your business, the more free that you are.

If your business only generates revenue or income, when you’re working every single day, then you aren’t financially free.

Because in order to have more money, you need to spend more time.

If you can produce a business that operates whether you’re there or not, that is true financial freedom.

I’m a speaker, and the speaking business isn’t really a business, speaking is a job because I only get paid money for my time.

Our coaching business is a real business because we can sign clients and they can be coached by people other than me.

And that generates money when I’m not there.

You can do this for any professional services.

You generate leads or you build a machine that generates leads, and then other people on your team help you service those clients.

That is a real machine.

That is a business.

That is financial freedom.

Less Uncertainty

The third key to financial freedom as an entrepreneur is the less uncertainty you have, the more free you are.

Now what does that mean?

It means first of all, that you know all the details.

For example, knowing your exact account balances helps out A LOT.

For a lot of entrepreneurs, our personal finances and our business finances are mixed together and that creates a lot of uncertainty when it comes to knowing where money is coming and going.

You have to be sure about your balances.

And you have to know, at any given moment, who owes you money and who you owe money to and where money is coming in from and where money is going.

The more you have those details locked down, the more financial freedom you’ll experience.

When you have uncertainty, you have fear and when you have fear, you feel trapped.

But when you have clarity, you have confidence and when you have confidence, you have freedom.

This also applies to being sure about your budget.

I am shocked how many business owners don’t actually create a budget.

They don’t actually create a plan or forecast of not only revenues expected to come in, but also the expenses going out.

When you have a budget, it makes you feel okay about spending money. You’ve already preplanned for it.

You already have a strategy for knowing that as long as you’re hitting your revenue, spending this money is okay.

It’s part of the plan.

But if you don’t know what’s coming, and you need to invest in your business, it creates stress, makes you feel trapped.

It’s uncertainty.

It’s unclear.

It’s fear. And it is NOT financial freedom.

The other part about certainty is being sure about your business development.

The more certain you are about where your next lead is coming from and where your next sale is coming from, the less stress you will have and the more free you will feel.

But if you don’t have a predictable set of mechanisms and strategies, you never know where your future leads are coming from, and you can’t track them.

And so you have uncertainty about how many leads you’re going to have next month.

A great business, a business that provides true financial freedom, is one that provides predictable revenue.

And in order to have predictable revenue, you need to have predictable lead flow.

And in order to have predictable lead flow, you need to have predictable strategies and predictable execution.

So those are the three places that financial freedom really comes from as an entrepreneur.

Less debt.

More delegation.

Less Uncertainty.